In recent years, the banking industry has undergone a significant transformation due to digital innovation. This transformation involves reimagining the way financial institutions operate and interact with their customers, not just adopting new technologies. The heart of this evolution is the emerging approach of digital maturity – a key driver for the integration of advanced technologies and strategies into every aspect of a financial institution’s operations.

What does digital maturity mean?

Digital maturity refers to an organization’s ability to effectively use digital technologies. This includes adopting digital technologies, as well as strategically integrating them into business processes. For financial institutions, achieving digital maturity means staying ahead of the competition by embracing innovation, automation and customer-centric solutions.

The Digital Maturity model

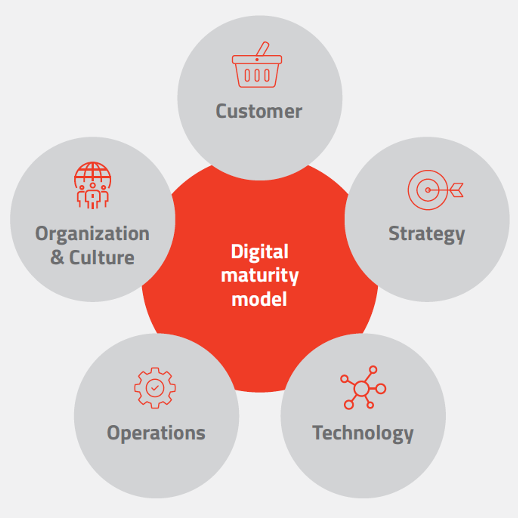

„A tool to enable digital transformation” – The Digital Maturity Model (DMM), designed by Deloitte in partnership with the TM Forum, evaluates an organisation’s digital capabilities and maturity across five dimensions. It also provides a roadmap for organisations to follow in their digital transformation journey:

- Customer

Delivering a customer experience where customers see banks as their partners, interacting through their preferred communication channels in both digital and traditional spaces. - Strategy

From a strategic perspective, the business is focusing on increasing its competitive advantage and efficiency through digital transformation. - Technology

Support a digital strategy using the latest technologies that focus on customer needs and efficiency, while optimising financial resources. - Operations

Enhance and streamline business processes and operations using advanced digital technologies to support strategic initiatives and drive business performance. - Organisation & Culture

Defining and creating an organisational culture that supports digital development to achieve growth

The DMM benchmark model enables the reprioritisation of focus within the 5 dimensions. This allows businesses to focus their activities on the areas that have the biggest impact on their business performance. Through this analysis, companies can identify areas for improvement and develop a roadmap for achieving their targets.

The current status of digital maturity at banks

Digital transformation initiatives in the banking sector have seen the extensive adoption of a wide range of digital solutions. These involve the implementation of advanced analytics systems, artificial intelligence (AI), and machine learning to streamline processes, boost decision-making capabilities, and improve the customer experience. The extensive adoption of mobile banking applications, on-demand financial management tools, and contactless payment solutions has transformed the customer journey in financial services.

How does digital maturity appear at debt collection?

Modern banks have extended their digital capabilities to debt collection processes, recognising the significant benefits of automating and streamlining these operations. Advanced analytics, AI-driven decision-making, and automated communication channels such as self-service applications with integrated chat functionalities are now pivotal in modern collection methods. Machine learning algorithms analyse customer behaviour to predict trends and personalise collection approaches. Personalised outreach and self-service apps empower customers and support a seamless customer experience.

Digital maturity is essential in debt collection

- Efficiency: Digital tools can streamline and automate many aspects of the debt collection process, minimising the need for manual action. For instance, automated reminders and notifications can be sent to debtors, freeing up agent time to focus on more complex tasks.

- Accuracy: Digital systems can analyze vast amounts of data to identify patterns and trends, enabling more accurate decision-making. For example, predictive analytics can estimate the likelihood of debtors repaying their debts and prioritise collection activities accordingly.

- Personalization: It enables personalised communication with debtors, leading to higher engagement and better recovery. By personalising messages based on debtors’ preferences, financial institutions can increase the success rate of debt collection.

- Compliance: Digital systems can help ensure compliance with regulatory requirements and industry standards. It can reduce the risk of errors.

- Customer Experience: Most importantly, digital maturity can significantly enhance the overall customer experience through convenient self-service applications, clear and transparent communication, and personalised support. Financial institutions can minimise the negative impact of debt collection and foster valuable relationships with clients.

- Self-Service applications: The platform enables debtors to access their account details, make payments, and communicate with financial institutions at their convenience, reducing the complexity and improving the overall customer experience.

- Improved Collection Rate: Financial institutions can achieve a better collection rate and improved efficiency by using data analytics and early warning systems to select the most effective collection methods.

In conclusion, achieving digital maturity in banking requires more than just implementing cutting-edge technologies. It involves seamlessly integrating innovations into the core operations of financial institutions. Banks that embed digital strategies into their business DNA can achieve a higher level of success.

In the debt collection view, digital maturity holds great potential to improve efficiency, accuracy, and customer experience. Financial institutions can improve their debt collection efforts and achieve better collection results by adopting advanced digital tools and strategies while increasing the customer experience.

For deeper insights into enhancing customer experience and improving collection effectiveness, we encourage you to download our latest white paper.