Loxon Collateral Management System allows financial institutions to streamline and monitor their collateral portfolio within a structured framework and comprehensive data model. All types of collaterals are managed including commercial and residential real estates, moveables, equipments or any other tangible or intangible assets with dedicated fields and documents.

COLLATERAL MANAGEMENT

An efficient tool for reducing credit risk

- Request a demoRequest a demo

- Download product brochure

The solution supports all loan-collateral related activities: the whole collateral lifecycle management from registry until the collateral is released, with built-in workflow engine. The system supports the indirect load of collaterals and deals from primary registry systems as well as direct collateral and deal storage.

Providing complex and full range support to the legal collection of collaterals, the Collateral Management System also supports execution of the collaterals connected to defaulted deals and liquidation of bankrupt deals’ collaterals.

Features and functions

Collateral database(registry)

- Lifecycle management (workflow support)

- Calculation engine (allocation, analytics)

- Reporting/Monitoring

Main functions:

- Single collateral database

- Real Estate & Asset Registry

- Collateral valuation / Recalculation / Statistical revaluation

- Eligibility calculation

- Collateral allocation

- Collateral analytics / Simulations / Stress testing

- Collateral lifecycle management / Built-in workflow engine

- Auction

- Internal Appraisal / External appraiser processes / Mobile appraiser support

Uniqueness of the product:

Business expertise

- Business product with business flexibility

- Strong business expertise

- Strong and relevant experience & presence in collateral management

Reduced credit risk and improved enforceability

- Up-to-date, accurate and unified information about banking book

- Collateral quality

- Cross collateralization

- Continuous classification and valuation of collaterals

- Automatic & manual revaluation methods

- Better credit decisions and credit risk modelling

Reduced cost of capital

- Eliminating inaccurate, unclassified data

- Basel III and IFRS eligibility and allocation

- Collateral analytics

- Input to optimize RWA and provisioning

Simplified and standardized operation

- Automated and fully audited out-of-the-box processes; reduced cost

- Unified collateral key (unique ID) across IT applications

- Traceability of reporting data

- Streamline data infrastructure

- Monitoring processes in order to intervene in time

- Management, drill-down & analytics reports

Benefits for the customer

- Complete solution (All business lines (retail, non-retail) & all kind of collaterals are supported)

- Reduction in capital (RWA Optimization)

- Improve collateral coverage (LTV)

- Optimizes provisioning

- Data consolidation and improvement of data quality

- Increased operational efficiency

- Compliance with Basel Regulations

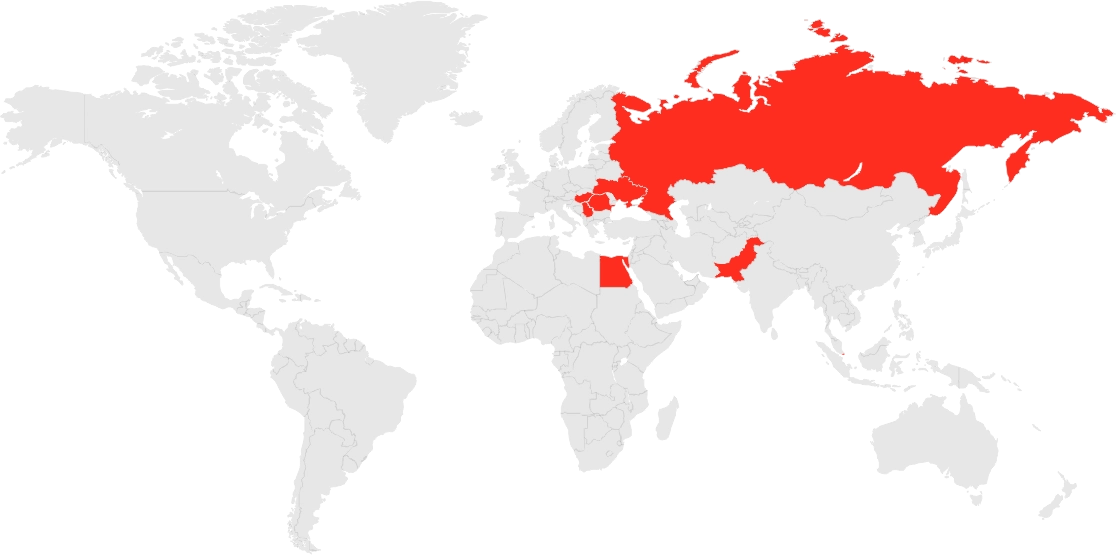

Countries we have implemented

Europe: Hungary, Albania, Serbia, Ukraine, Russia, Romania

Africa: Egypt, Asia: Singapore, Pakistan

Highlighted customer references

Raiffeisen Bank International

- Group wide implementation for several countries from Romania and Russia to Singapore

- End-to-end coverage for collateral management in respect of banking book, supporting retail, SME and wholesale banking departments as well

- Scalability, 5+ million exposures and 2+ million collaterals managed

- Full or partial automation from data management & workflow perspectives, serious cost reduction

- Collateral optimization

- Deep integration with existing IT landscape (core banking systems, loan origination systems, general ledger system, central registries)

- Complete, accurate and readily available information about the entire banking book

- Regulatory compliance and reporting

Egyptian Collateral Registry (powered by i-Score)

- Central, country-wide movable registry with public portal

- 70 – traditional and Islamic – banks, financial institutions and leasing companies are using it on daily basis

- Tens of millions of movable collaterals, like vehicles, machineries

- End-to-end coverage for registration, publication and lifecycle management of rights, including certificate generation

Testimonials

Our product brochure is ready to download

Loxon in numbers

0 +

Customers

0 +

Countries

0 +

Years on the market

0

Business solutions

0

Regional offices

0 +

Colleagues

We would love to hear from you

Let us find the best credit management Business Solutions for you. Our seasoned professionals would love to contribute their expertise and insights to your next big project.

An expert from us is waiting for your message

If you prefer to send us a message, please complete the form below and we will get right back to you