Provisioning standards have been significantly improved in the previous years, requiring enormous resources from the Banks to comply with the regulatory and internal requirements.The Loxon IFRS 9 Calculation Engine is a system providing a comprehensive solution for automatic calculation of Loan Loss Provisions based on IFRS 9 regulations and country specific rules.

Making IFRS implementation easier for everyone. Run and grow your business with us!

- Request a demoRequest a demo

- Download product brochure

Why Loxon IFRS 9

- ensuring the use of internationally standardized methodologies and regulation reflecting IFRS 9 requirements

- support of different provisioning processes according to business segments

- a flexible enough system, that allows to freely modify the existing algorithms or their incoming dataset

- full support of IFRS 9-based accounting classification and measurement calculation

Uniqueness of the IFRS 9 engine

The system automates data collection, accounting classification and measurement, portfolio building, classification, PD/LGD calculations, provision calculation and reporting in order to reduce redundant work, standardize provisioning process, increase internal controls and maximize data quality and calculation reliability.

Expert speaks

Since a financial institution is exposed to various risks, especially credit risk, which relates to the possible change in the credit quality that affects the profit of the institution, the Bank’s primary aim is to calculate ECL and provision as precisely as possible. In this way the financial institution is able to create reserves against credit losses, presents true and fair view about the value of its portfolio, and complies with national and international regulations.

The mentioned became extremely important during the financial crisis, both for the banks and for the regulators since the banks underestimating their risks have found themselves in trouble while their states had to decide in certain situations whether saving them for a huge cost or leaving them to fall is a better solution.

Taking into account the experience learnt during the crisis new standards have been issued in 2014, called IFRS 9. The standard contains significant changes compared to the IAS39, where the different segmentation (Stage 1-2-3 instead of PLLP/ILLP) and lifetime ECL determination are only a fraction of the required changes. For the proper asset evaluation and impairment, banks must classify their assets by performing SPPI test. Based on the result of this classification, banks must apply different measurement, evaluating and provisioning methodologies. To apply the new changes significant involvement is required from multiple banking departments including accounting, risk, IT.

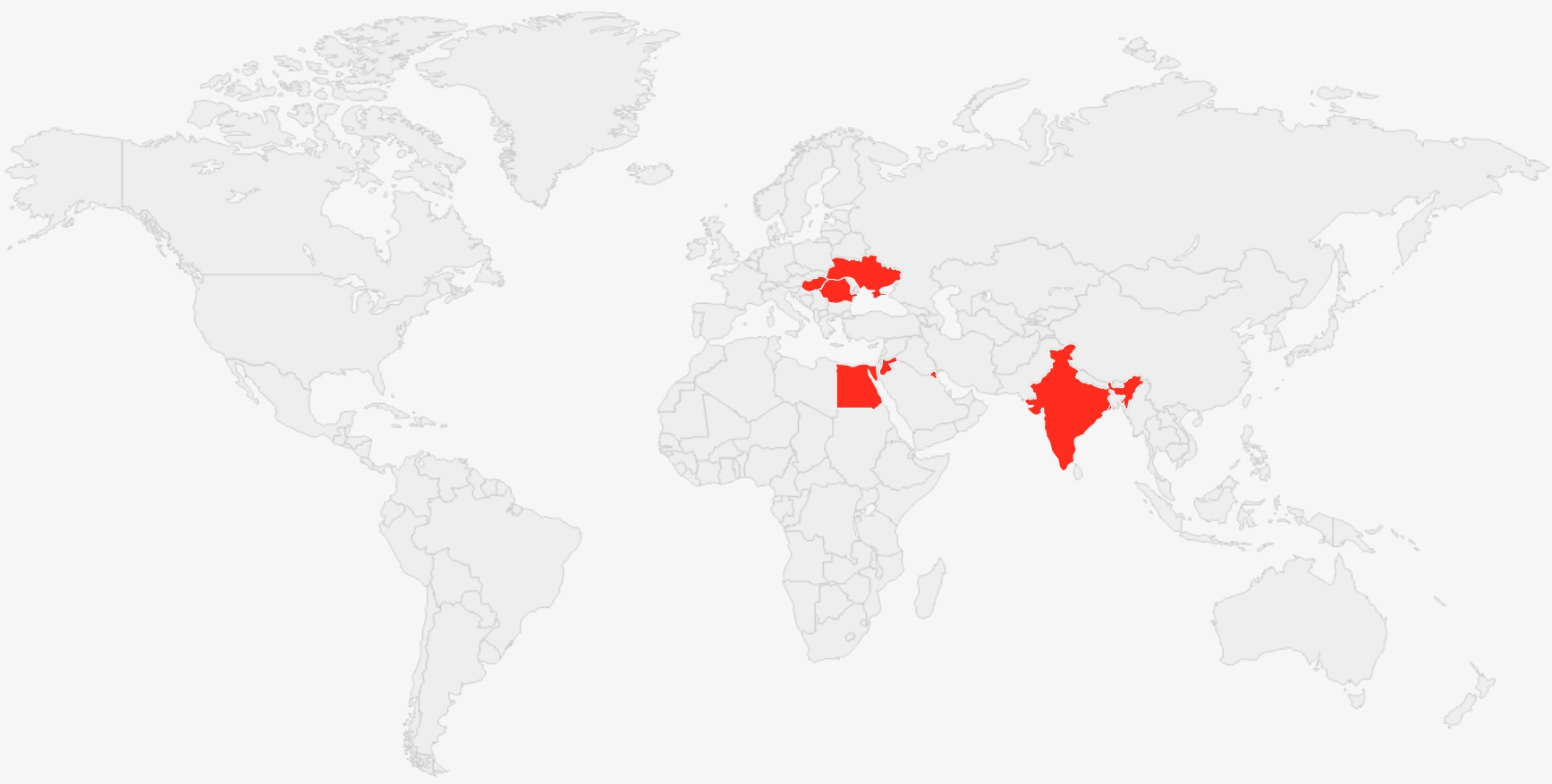

Each day IFRS 9 proves its benefits and added-value globally in the following countries

Our valued customers

Our product brochure is ready to download

Loxon in numbers

We would love to hear from you

Let us find the best credit management Business Solutions for you. Our seasoned professionals would love to contribute their expertise and insights to your next big project.