Loxon’s next-generation Collection System is a business solution designed to

support financial institutions with personalised collection strategies and

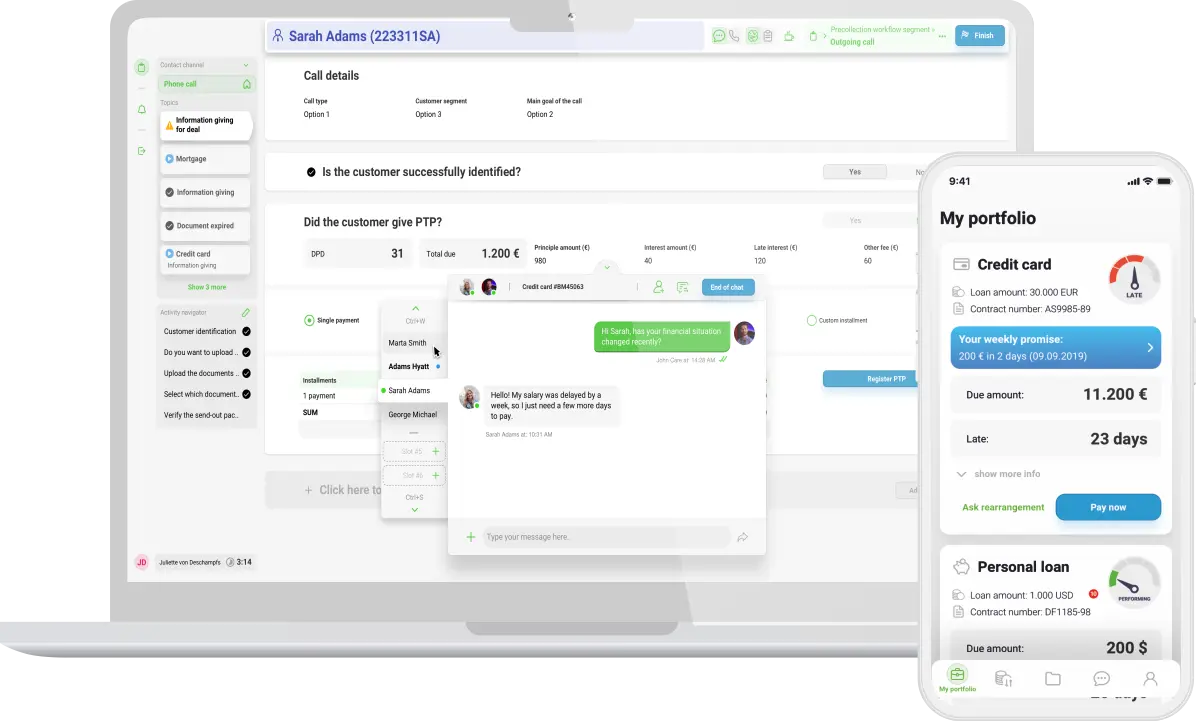

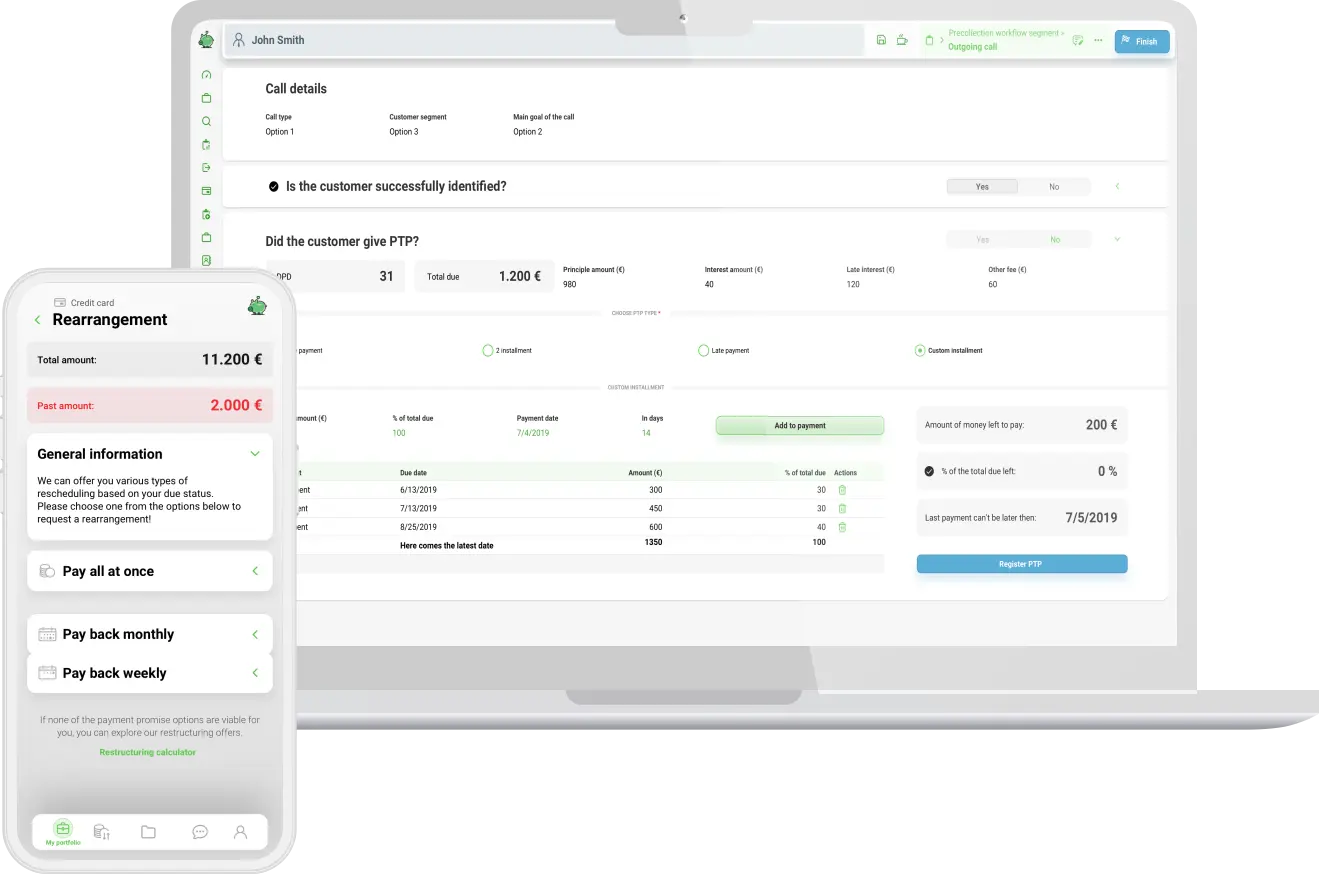

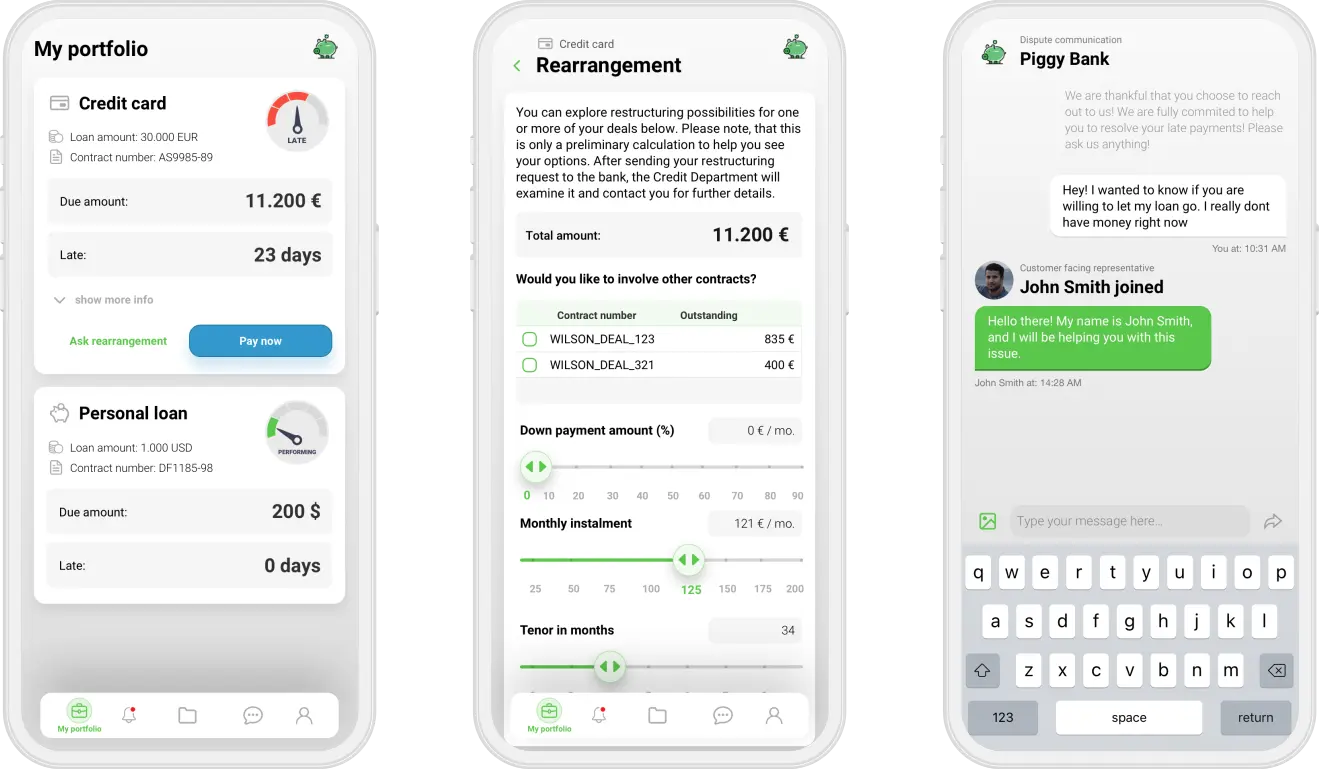

strengthened customer relationships. It focuses on omnichannel communications

and self-service payment methods so banks can build closer relationships with

customers, ultimately leading to better solvency and financial returns.

Trusted by more than 25 clients worldwide

Discover the power of Loxon's next-generation Collection

System empowered by advanced AI

Our next-generation collection service is a cloud-native business solution that has been designed to help banks manage delinquencies and maximise recoveries through personalised strategies. With AI-powered capabilities, it provides real-time insights into customer payment behaviour, enabling proactive identification and prevention of delinquency risks.

Why our clients love us

TRUE SOFTWARE-AS-

A-SERVICE MODEL

Why consider

Loxon’s

Collection SaaS?

No CapEx.

No maintenance.

Continuous innovation.

Collection On-premises

For some of our clients, staying on-prem is a strict requirement. Loxon’s end-to-end collection system is used by leading financial institutions across the world. It is designed for reliability, efficiency and flexibility for institutions that want to radically improve collection outcomes and customer satisfaction.

What we achieved at part of Collection?

accounts treated

past due loans

What takes collection impact to the next level?

Level up responsible collection practices for a higher positive impact on

customers and the bottom line:

- Real-time analytics-based early hardship detection for delinquency prevention

- Continuous monitoring of vulnerability risk indicators and provision of tailored assistance

- Compliance automation based on parameters and automated workflows

- Advanced regulatory reporting and data provision capabilities

- A record of all collection events to ensure auditability

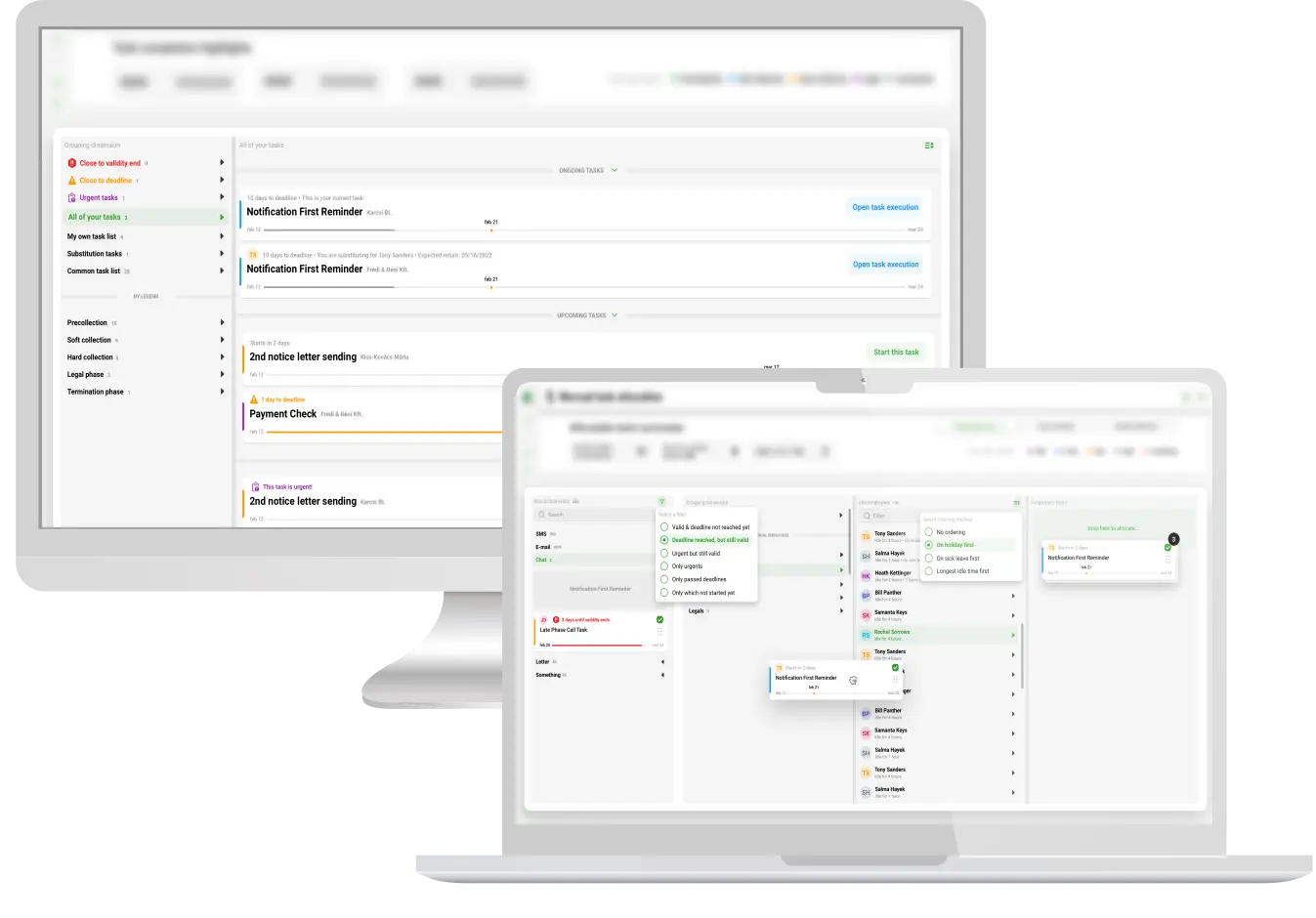

We have some exciting screens for you

Integrated low code/no-code

builder for high flexibility and

better responsiveness

The no-code capabilities overarch the entire

composable application experience from the stage of

building the system through parameterisation to the

customisation of workspace user interfaces.

It offers the following simultaneously

- API builder

- Data modeller

- Segmentation and status management too

- Automated workflow builder

- Communication strategy builder

- Business logic and decision designer

- UI builder

Get the product sheet

Our product sheet is ready to download

Associated White Paper

Related solutions

For some of our clients, staying on-prem is a strict requirement. Loxon’s end-to-end collection system is used by leading financial institutions across the world. It is designed for reliability, efficiency and flexibility for institutions that want radically to improve collection outcomes and customer satisfaction.

Loxon’s early warning system is a risk monitoring application providing efficient support to your credit monitoring activity. The main goal of EWS is to identify possible threats in retail and/or non-retail credit portfolio (in early stage) and to support the Bank to take the necessary measures on time.ion outcomes and customer satisfaction.

We would love to hear from you

Let us find the best credit management Business Solutions for you. Our seasoned professionals would love to contribute their expertise and insights to your next big project.